Building a Sustainable Workforce: Greening the Built Environment

- rs1499

- May 29, 2024

- 2 min read

Updated: Dec 11, 2024

A report + market map

The built environment encompasses homes, offices, commercial and public buildings.

To be able to green the built environment, we need both tools and talent. The tools being the hardware and software, and the talent being the European workforce with the necessary skills. i.e. to install a solar panel on a house, someone needs to be trained to do that.

What is the link to Edtech?

If the workforce can be trained and supported using technology, the opportunities to train at scale, retain, revise and upskill are all enhanced!

Brighteye and Ufi Ventures have collaborated to produce this report to:

Quantify the scale of the problem

Define the types of green skills need in the built environment

Highlight specific opportunities for start-ups and sector players

Share examples of what is working

Map the landscape

What's in scope?

The summary

Buildings account for ~30% of global energy consumption and 15% of global freshwater consumption.

Buildings can be made ‘greener’, or more energy efficient, in a range of ways, from solar panel installation, to energy efficient appliances, to heating and cooling systems, to glazing and lighting. Each type has variable costs, ROIs and ROI periods for new builds and retrofitting.

The policy direction is clear, with the European Green Deal, Energy Company Obligation and Building Regulations in the UK, Inflation Reduction Act in the US, Greener Homes Grant in Canada and National Construction Code in Australia, all featuring specific green buildings policies and varying levels of support.

A number of roles are necessary to enable the greening of the built environment, but the true scale is tough to determine - there is limited visibility on skills projections. There are a couple of possible explanations, one of which is that the data simply isn’t known, linked to the fact that many of the required roles are pivots to existing roles, such as electricians, as opposed to creation of new roles.

There is significant investor interest in companies in the space with 11/12 investors engaged in the report(3), exploring green collar opportunities- however there has been a limited number of deals thus far.

High density of companies responding to the training demands, with particularly high density in solutions providing high frequency, upskilling or ‘enhancing’ learning. The ‘enhancing’ sub-sector includes admin tooling, productivity tooling, and building design tools. There are early examples of companies starting to scale across all three segments and expand to access multiple building efficiency areas.

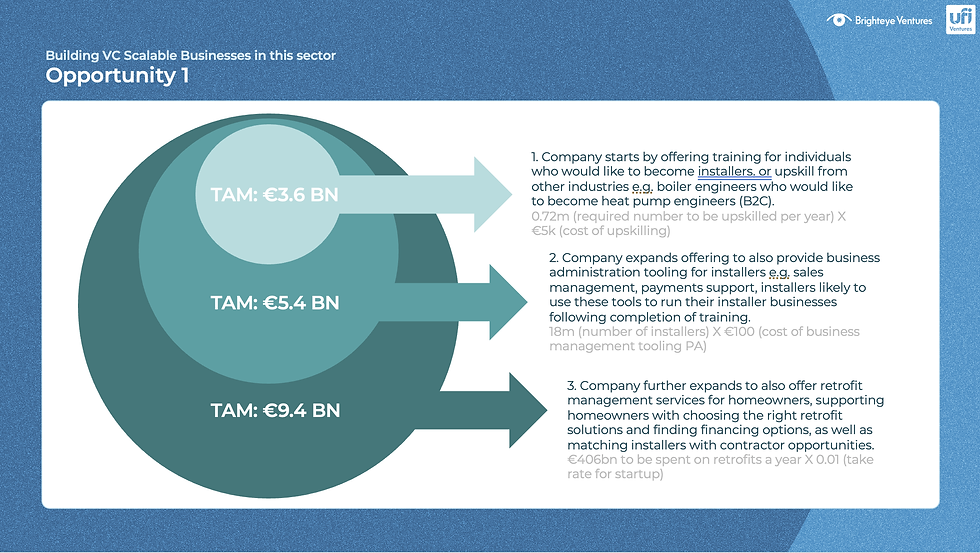

Considerable opportunities are present when considering a ‘training +’ approach – companies that are providing training as well as an additional ecosystem of support, such as ‘training + business administration support’ for small company owners; ‘training + productivity tools’; and ‘training + compliance support’. All three of these – and there will be other opportunities(!) – provide billion-dollar opportunities.

The market map

Opportunities to build VC-scale businesses

We formed overviews of three opportunities to build VC-scale businesses in the space. Here's an example from the report...

Explore these opportunities and the wider report via the link below!

Comments